2023-05-09

In 2022, the US furniture imports in terms of source countries and categories, what are the changes?

The import and export data of US furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furnitureUS furniture in 2022 came out, and the market pattern again showed subtle changes. This paper first analyzes some important data and trends of the source countries of American furniture. In the export market of furniture to the United States, China and Vietnam have been discussed as the top two source countries recently. Back in 2020, Vietnam briefly surpassed China as the top exporter of furniture to the United States.

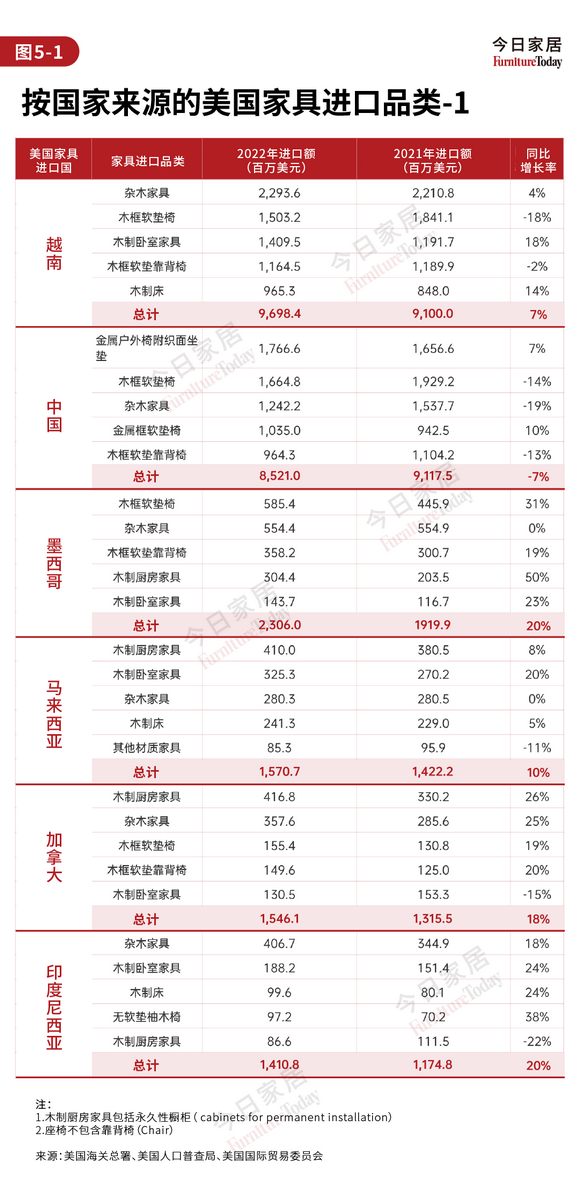

By 2021, however, China had reclaimed the top spot, with Vietnam one move behind. In a dramatic twist, Vietnam regained the top spot it had won in 2020 in 2022, with China also in second place, just $17.5 million behind.

So what will happen in terms of countries of origin and types of furniture imported to the United States in 2022?

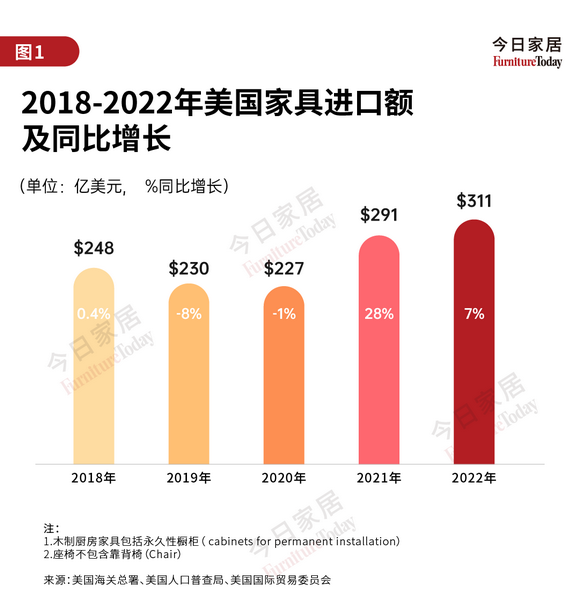

The total amount of furniture imported to the US increased slightly by 7 percent

In 2022, furniture imports in the US edged up 7 percent from a year earlier to $31.1 billion. In 2021, furniture imports jumped 28 percent, spurred by the pandemic. But the slowdown in 2022 will still be better than in the past. In fact, US furniture imports have been less than ideal over the past few years, and imports in 2019 and 2020 will be -8% and -1%, respectively.

Vietnam's furniture exports to the United States rose 7 percent in 2022 to nearly $9.7 billion. U.S. furniture imports from China, on the other hand, fell 7 percent to about $8.5 billion, and their market share fell to 28 percent.

In 2021, China and Vietnam each accounted for 31 percent of U.S. imports, separated by just $17.5 million.

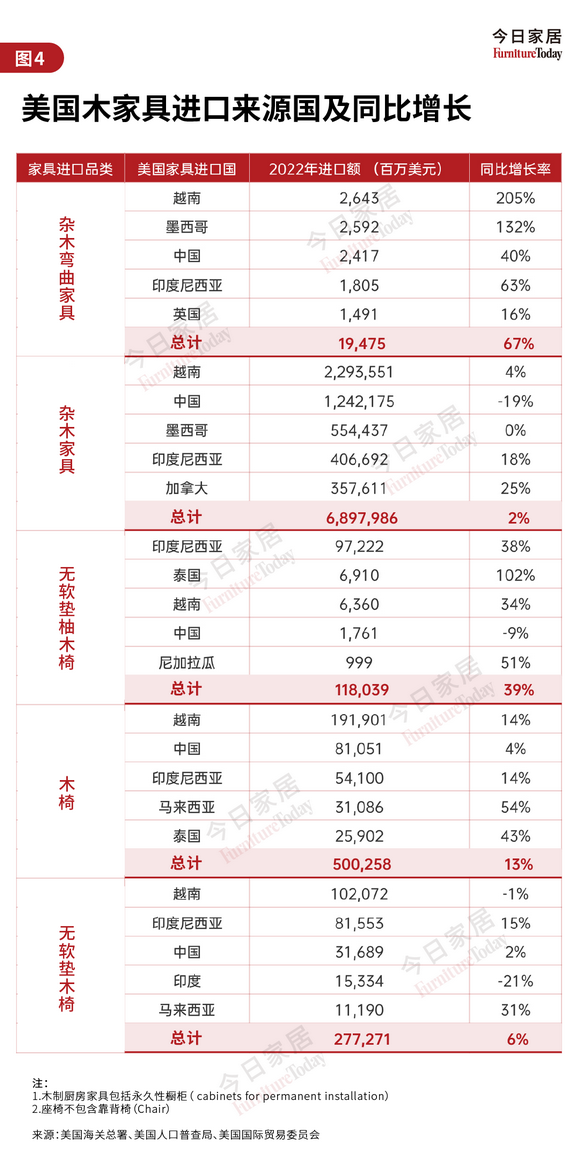

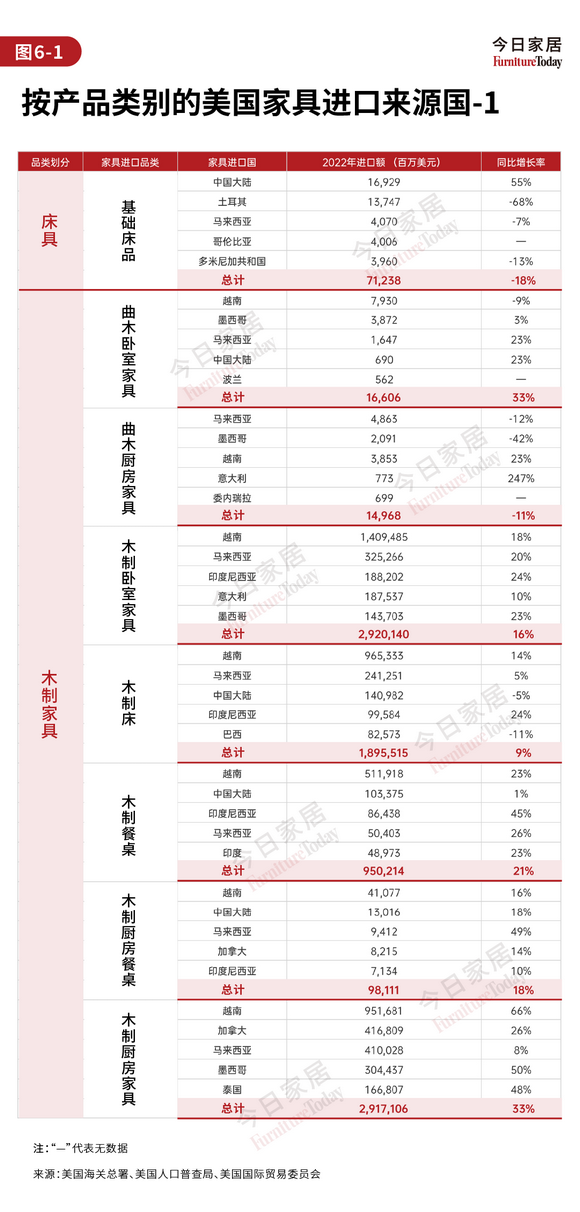

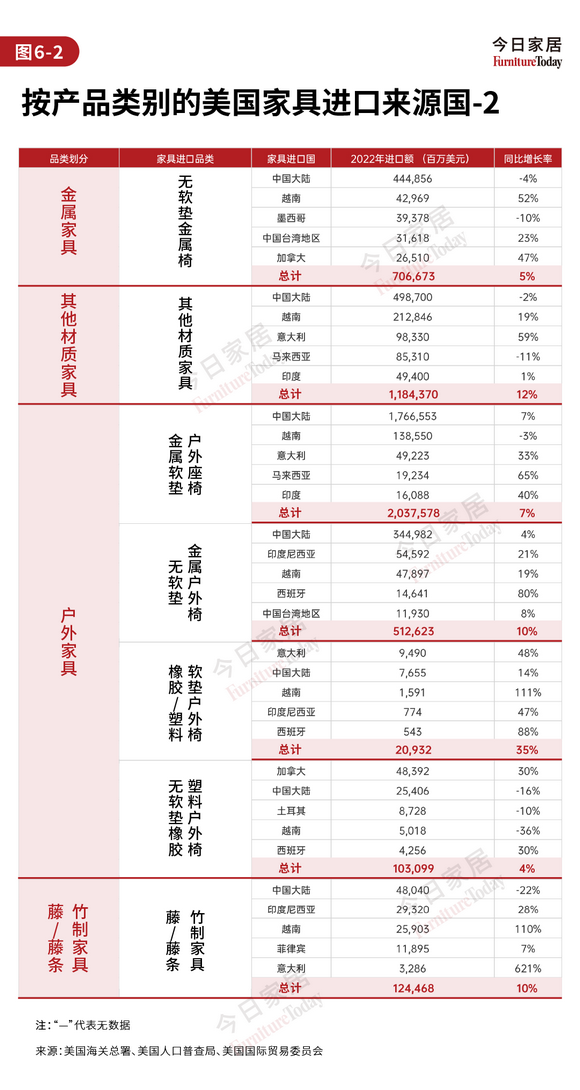

According to research, Vietnam is the No. 1 source of furniture imports to the United States mainly because of its wide range of furniture exports. The increase in sales across all categories increased Vietnam's market share to 23 percent, while its 7 percent increase in U.S. furniture imports in 2022 was mainly due to increased exports of miscellaneous wood furniture, wooden bedroom furniture and wooden beds. At the same time, there was a decline in furnishings (wood-framed seats, wood-framed backrest chairs).

In 2022, three of the five major categories of Chinese furniture imported to the United States (wood-framed upholstered chairs, backrest chairs, miscellaneous wood furniture) declined by double digits, while smaller increases were recorded in the new major categories (metal outdoor chairs with woven upholstered upholstered chairs, metal-framed upholstered chairs).

Jade Russell, chief operating officer and global sourcing specialist at Design Environments, an interior design company based in Marietta, Georgia, said she was not surprised that Vietnam had become a major source of imports to the United States, or that China had lost some market ground.

"There's still a lot of capacity in Vietnam and China... And China is not out of business, "she said, though continued tariffs could make it harder for China to keep pace, especially as some Chinese furniture owners have already bought factories in Vietnam. "The shift is not surprising, and it's likely to continue," she said. Mexico

Total global furniture exports rose 7 percent to a record $31 billion in 2022, compared with just over $29 billion in 2021.

Looking back over the past few years, the United States has experienced a roller-coaster ride in the import market, with negative growth in 2019 and 2020, followed by a 28 percent jump in 2021 and now a modest increase in 2022.

Of the top 10 sources of furniture imports to the United States, all except China saw their import numbers grow, though not as strongly as in 2021, but all of them experienced double-digit growth except Vietnam, which grew 7 percent.

Mexico, for example, remained the third largest source of imports to the United States, with imports growing 20 percent to about $23 billion, but that was underrepresented by the 61 percent year-over-year growth in 2021. Mexico consolidated its position as the third largest source, pulling away from Malaysia.

The main furniture category imported from Mexico to the US was wood-framed upholstered chairs, which grew by 31%, displacing miscellaneous wood furniture at the top spot, unchanged from 2022. However, its biggest growth came from wooden kitchen furniture, which rose 50 percent from $100 million to $304.4 million.

Russell called Mexico a "great choice," noting that when container rates spiked, suppliers found Mexico to be a convenient alternative able to deal with a fragmented supply chain. Russell compared the current situation in Mexico to the early days of doing business in Asia, which required learning knowledge and skills in areas such as quality and delivery.

"It's a culture and a region like no other, and they give you what you want, but on-time delivery is an issue." With container rates falling and infrastructure still in place in China and other parts of Asia, reliance on Mexico could shift, she said.

Still, she said, "Mexico is strong in seats and wooden furniture, and increasingly strong in metal manufacturing."

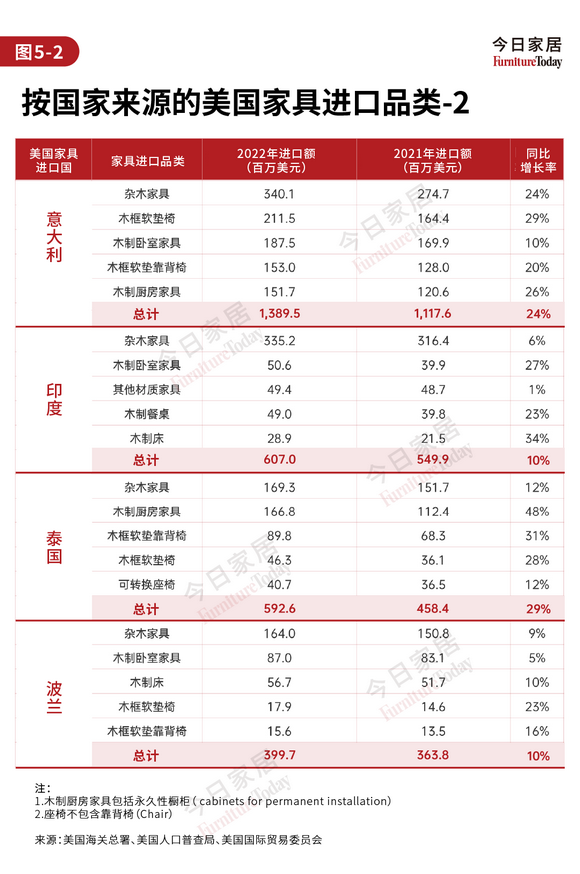

Four countries -- Malaysia, Canada, Indonesia and Italy -- have already achieved a close ranking, and given the 2022 data, any one of them could take fourth place in 2023.

Malaysia's 10 per cent growth was the smallest among the four countries, with imports totalling US $1.571 billion, slightly ahead of Canada.

Canada exported US $1.546 billion of products to the US in 2022, an 18 per cent increase from 2021. Indonesia and Italy joined the fray with increases of 20 percent and 24 percent, respectively, separating the fourth and seventh largest source of imports by a mere $181.2 million.

While Canada's recent numbers have been good, Russell said the U.S. 's neighbor to the north is still grappling with labor issues, both finding new workers and retaining existing ones, which could hinder its greater growth.

Indonesia, which Russell called "a place to watch," has been on the radar of Chuck Foster, CEO of U.S. wooden furniture supplier American Woodcrafters, who has been doing business there for more than 15 years.

"When the tariffs first hit China, we focused our bedroom business on Indonesia," Foster said, adding that they work with five or six manufacturers at the same time and have consolidated their presence there. One of Indonesia's selling points is the availability of cultivated natural resources such as mahogany, acacia, rubbowood, pine and teak if you are willing to pay.

In terms of Indonesia's growth potential, Foster said the current business climate was deterring Indonesian manufacturers from making large-scale infrastructure investments. Still, "the price, scale and skill level there is perfect for our needs." "He said.

Both Russell and Foster noted that because of the pandemic and its challenges, and the current focus on managing labor costs, people are more flexible where they do business.

"People are exploring that right now," Russell said. "They're looking at what other people have done, and do they have the expertise to deliver the quality they need in an uncharted territory?"

India ranks seventh among the top 10 sources of furniture imports to the United States, not far behind Indonesia and likely to grow in the future. "One of the keys is how close they are to natural resources and whether they have the resources and materials that people want," Russell said.

While Thailand is significantly smaller in the US import market, imports rose 29 percent year on year to $593 million, after growing 55 percent in 2021.

India and Poland ranked eighth and tenth among the top 10 sources of furniture imports to the United States, with imports each increasing by 10 percent in 2022, although this is not the same as India's 58 percent and Poland's 46 percent growth in 2021.

For small producers like Poland, Russell said, it will be more important to see if local companies can meet the needs of U.S. buyers. "That's one place to watch," she said,especially whether they can target the right price points in the market and open market demand. In

In the next tier of countries of origin for U.S. furniture imports in 2022, Cambodia, Germany, Spain and Romania saw business growth of 20 percent or more, while France (48 percent), Lithuania (63 percent) and Norway (80 percent) saw even more significant growth.

Article source::今日家居 Furniture Today

last:no more